Investing in the stock market can be a daunting task, especially if you’re just starting out. Thankfully, many experienced investors and traders have shared their wisdom in the form of books that can guide you along the way. Whether you’re a novice or someone looking to refine your strategies, the following nine books provide valuable insights that can help you succeed in the world of stocks.

List of 9 books for Stock market

Let’s examine the summaries of these must-read books, learn about their authors, and explore why they are essential for anyone interested in the share market.

1. Reminiscences of a Stock Operator

Summary:

This classic book is a semi-autobiographical account of the life of Jesse Livermore, one of the most famous stock traders of all time. The narrative takes you through the ups and downs of Livermore’s trading career, offering timeless lessons on market speculation, psychology, and the inevitable cycles of boom and bust.

- Author: Edwin Lefèvre

- Year Published: 1923

Why You Should Read It:

“Reminiscences of a Stock Operator” is not just about trading techniques; it’s about understanding the mindset required to succeed in the stock market. The lessons from Livermore’s experiences are as relevant today as they were nearly a century ago. This book is a must-read for anyone who wants to grasp the emotional and psychological challenges of trading.

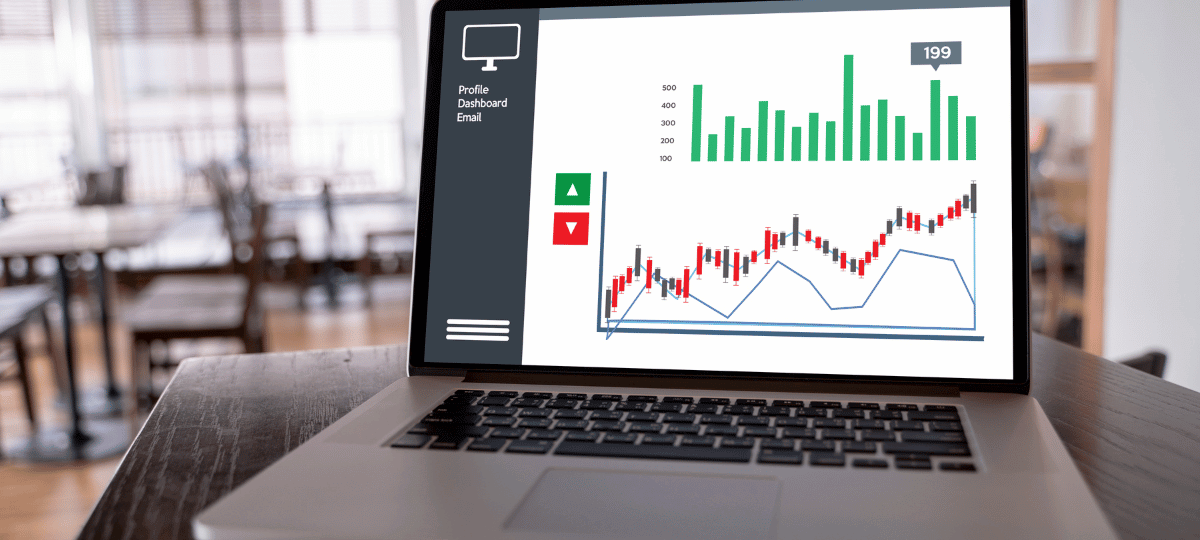

2. Trading in the Zone

Summary:

Mark Douglas delves deep into the psychology of trading, emphasizing the importance of discipline and mental toughness. “Trading in the Zone” addresses the common psychological pitfalls that traders face, such as fear, greed, and overconfidence, and provides strategies to overcome them.

- Author: Mark Douglas

- Year Published: 2000

Why You Should Read It:

The stock market isn’t just about numbers; it’s also about managing your emotions. Douglas’s book is invaluable for traders who struggle with consistency due to psychological barriers. Reading this book can help you develop the right mindset to trade with confidence and discipline.

3. Technical Analysis of the Financial Markets

Summary:

This comprehensive guide covers everything you need to know about technical analysis, a method of evaluating securities by analyzing statistics generated by market activity. Murphy explains various charts, indicators, and patterns in detail, making it accessible even for beginners.

- Author: John J. Murphy

- Year Published: 1999

Why You Should Read It:

This book, Technical Analysis of the Financial Markets, is an essential resource for anyone interested in understanding the mechanics of price movements and predicting future trends. It serves as a solid foundation for anyone looking to master technical analysis.

4. Japanese Candlestick Charting Techniques

Summary:

Steve Nison is credited with introducing Japanese candlestick charting techniques to the Western world. His book explains how these charts can be used to identify patterns and trends in the market, providing a visual representation of market sentiment.

- Author: Steve Nison

- Year Published: 1991

Why You Should Read It:

Candlestick charts are a powerful tool in technical analysis, and Nison’s book is the definitive guide on the subject. Whether you’re a novice or an experienced trader, understanding these techniques can greatly enhance your trading strategy.

5. Common Stocks and Uncommon Profits

Summary:

Philip Fisher’s book is a cornerstone of growth investing. He outlines the qualities to look for in a company before investing and stresses the importance of understanding a company’s management and products. Fisher’s “15 points to look for in a common stock” is still widely used today.

- Author: Philip Fisher

- Year Published: 1958

Why You Should Read It:

For those interested in long-term investing, this book offers valuable insights into selecting stocks that have the potential for significant growth. Fisher’s principles are timeless and have influenced legendary investors like Warren Buffett.

6. One Up on Wall Street

Summary:

Peter Lynch, one of the most successful mutual fund managers of all time, shares his investment philosophy in this classic book. He emphasizes the importance of investing in what you know and doing your own research rather than relying on market trends or experts.

- Author: Peter Lynch

- Year Published: 1989

Why You Should Read It:

Lynch’s approach is straightforward and easy to understand, making this book ideal for beginners. It empowers individual investors to trust their instincts and make informed decisions based on their own knowledge and research.

7. Encyclopedia of Chart Patterns

Summary:

This exhaustive reference book covers a wide array of chart patterns used in technical analysis. Bulkowski provides statistical data on the success rates of various patterns, helping traders make informed decisions based on historical data.

- Author: Thomas N. Bulkowski

- Year Published: 2000

Why You Should Read It:

If you’re serious about technical analysis, this book is an indispensable resource. It offers detailed information on how to identify and utilize chart patterns effectively, making it a valuable tool for both novice and experienced traders.

8. The Intelligent Investor

Summary:

Known as the “father of value investing,” Benjamin Graham’s book lays the foundation for a conservative and risk-averse approach to investing. Graham introduces the concept of “Mr. Market” and the importance of margin of safety, which has guided countless investors over the decades.

- Author: Benjamin Graham

- Year Published: 1949

Why You Should Read It:

For anyone interested in a disciplined and long-term approach to investing, “The Intelligent Investor” is a must-read. Its principles are timeless and form the bedrock of value investing, influencing investors like Warren Buffett.

9. Coffee Can Investing

Summary:

This book introduces the concept of Coffee Can Portfolio, a long-term investment strategy focused on high-quality companies. The authors argue that holding a select number of stocks for a long period, without frequent trading, can yield significant returns.

- Author: Saurabh Mukherjea, Rakshit Ranjan, and Pranab Uniyal

- Year Published: 2018

Why You Should Read It:

“Coffee Can Investing” is perfect for investors who believe in the power of long-term, passive investing. The book provides a fresh perspective on wealth creation and offers practical advice for building a portfolio that can withstand market volatility.

Conclusion

These nine books offer a well-rounded education on different aspects of the stock market, from technical analysis and trading psychology to long-term investing strategies. Whether you’re a beginner looking to understand the basics or an experienced investor aiming to refine your techniques, these books provide the knowledge and insights you need to navigate the complex world of the stock market. Happy reading!